Climate Volatility and Its Impact on Southeast Asia’s Rubber Economy

For decades, the natural rubber industry followed a largely predictable rhythm. Tapping cycles were governed by seasonal patterns, while prices were driven primarily by industrial demand and inventory levels. However, as the industry moved through 2025 and into early 2026, one factor has increasingly dominated decision-making across the supply chain: weather volatility.

Across Southeast Asia’s rubber-producing regions, climate change has shifted from a long-term concern to an immediate operational challenge. A combination of extreme weather events throughout 2025 disrupted production cycles, constrained supply, and reshaped market dynamics—resulting in a year characterised by firm prices but growing physical supply fragility.

A Convergence of Climate Anomalies

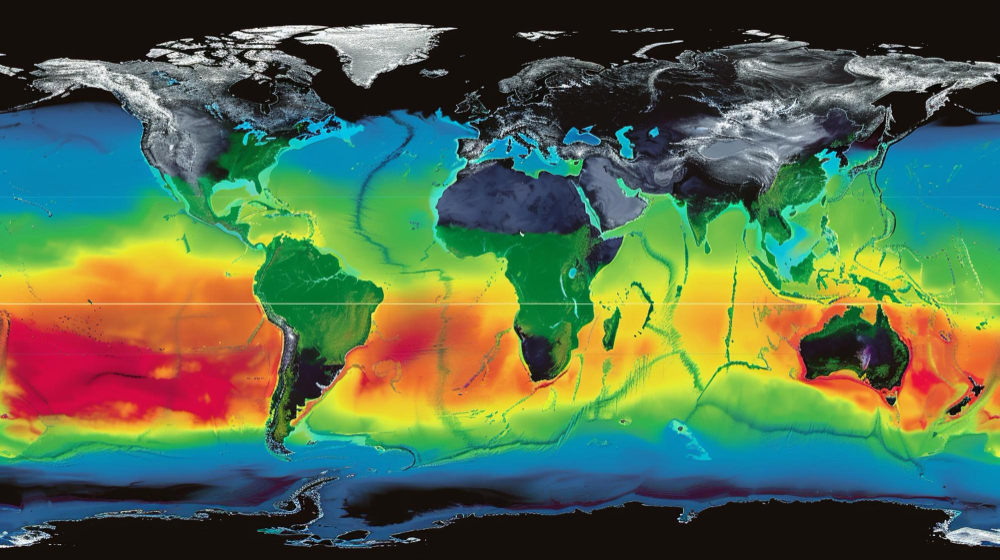

The disruptions of 2025 were not caused by a single event, but by the convergence of multiple ocean-atmosphere phenomena. A lingering La Niña coincided with a negative Indian Ocean Dipole (IOD), intensifying monsoon systems across the region.

Elevated sea surface temperatures in the South China Sea further amplified rainfall levels, driving prolonged and heavy precipitation across Thailand, Malaysia, Indonesia, and Vietnam. Critically, much of this rainfall occurred during periods traditionally associated with peak tapping activity, sharply reducing available production days.

Regional Impacts Across the Rubber Belt

While the effects were felt throughout Southeast Asia, the timing and severity of weather events varied by country.

Thailand, the world’s largest natural rubber producer, experienced the most significant disruption. According to the Rubber Authority of Thailand (RAOT), flooding in November alone affected more than 656,000 hectares of plantations and over 160,000 farming households. Total production losses for the year are estimated at approximately 90,000 tons, with overall 2025 output projected to decline by 4–5% compared to earlier forecasts.

Indonesia and Malaysia both faced pronounced challenges in the final quarter of the year. Intensified monsoon rains disrupted tapping schedules and slowed the movement of raw materials to processing facilities. Q4 production losses in both countries are estimated at around 15%. In Indonesia, export volumes fell sharply from 141,000 tons in September to 117,000 tons in October, underscoring increasing vulnerability within logistics and transport infrastructure.

Vietnam, despite experiencing seven typhoons during 2025, demonstrated comparatively greater resilience. Because many storms occurred before the primary tapping season, annual production declined by only around 2%. However, Q4 output still contracted by approximately 8%, reflecting the cumulative impact of weather disruptions later in the year.

Market Dynamics: Firm Prices, Constrained Supply

Despite reduced production volumes, global natural rubber prices remained relatively supportive throughout much of 2025. This created a notable paradox: lower physical supply coinciding with strong export revenues.

In February 2025, Thailand recorded its highest monthly rubber export earnings in eight years, reaching US$577.1 million, supported by STR20 prices trading above US$2,000 per metric ton. Vietnam also reported a more than 10% increase in export value during the first nine months of the year, even as shipment volumes remained largely flat.

By late Q4, however, the physical constraints of prolonged rainfall, waterlogged plantations, and reduced tapping days began to exert greater influence. Buyers—particularly in China—responded by advancing purchases in October, aiming to secure supply ahead of anticipated shortages in early 2026.

Looking Ahead: Adapting to a New Climate Baseline

The experience of 2025 suggests the industry is adjusting to a structural shift rather than an isolated anomaly. With global temperatures temporarily breaching 1.5°C above pre-industrial levels and Asia warming at nearly twice the global average, climate volatility is becoming a defining feature of the operating environment.

La Niña conditions are forecast to persist into the first half of 2026, reinforcing the need for proactive adaptation. For producers, traders, and buyers, resilience will increasingly depend on:

- Improved early-warning systems to support plantation-level planning

- Infrastructure investment, particularly in drainage and transport resilience

- Enhanced supply chain transparency to manage weather-related disruptions more effectively

For market participants, these developments highlight the growing importance of diversified sourcing strategies, forward planning, and close coordination across the supply chain.

As Southeast Asia’s rubber market becomes more closely tied to climatic conditions, the ability to manage environmental risk is emerging as a core commercial capability—alongside quality, reliability, and pricing. The companies best positioned for long-term success will be those that integrate climate resilience into both operational planning and strategic decision-making.