Malaysia's Natural Rubber Sector Faces Persistent Structural Challenges

Malaysia's natural rubber industry navigated through June 2025 displaying signs of both fragile recovery and ongoing systemic weakness. While production increased 5.9% month-on-month to reach 25,679 tons, this figure remained substantially below the 29,881 tons recorded in June 2024—a year-on-year decline of 14.1%. The second quarter's total output of 67,943 tons represented a dramatic 28.6% drop from the first quarter and an 11.5% decrease compared to the same period in 2024. Despite the modest monthly improvement, the overarching pattern reveals an industry continuing to grapple with fundamental instability.

Persistent Production Challenges Rooted in Structural Issues

Government initiatives designed to boost production—including replanting subsidies and smallholder assistance programs administered through agencies like RISDA—have proven insufficient to address the sector's core weaknesses. The industry continues to suffer from fragmented production frameworks, deteriorating tree stock, and minimal uptake of replanting initiatives among smallholders. June's elevated humidity during the southwest monsoon season likely constrained tapping operations and diminished latex yields, further compromising productivity levels.

The composition of Malaysia's rubber supply highlights a critical vulnerability: smallholders accounted for 84.7% of June's production, while estates contributed merely 15.3%. This overwhelming reliance on smallholder operations leaves the sector acutely exposed to price fluctuations, workforce shortages, and erratic productivity patterns. In contrast, Vietnam's rubber industry—where estate operations represent over half of total cultivation area—demonstrates greater capacity to manage market volatility. Malaysia's discouraged smallholder base, confronting unpredictable pricing, creates a supply framework that is inherently unstable and resistant to stabilization efforts.

Export Performance Deteriorates Month-Over-Month

Export volumes experienced significant deterioration during the period. June shipments contracted 17.3% from the previous month, totaling 29,719 tons. China maintained its position as the primary export destination, absorbing 33.9% of Malaysian rubber exports, with Germany securing 18.1%, the United Arab Emirates 9.6%, the United States 7.3%, and India 3.8%. Despite this diversified market portfolio, Malaysia proved unable to insulate itself from weakening international demand.

Downstream rubber products, particularly gloves, experienced declining momentum. Glove exports generated RM1.2 billion (US$283 million) in June, representing a 1.7% decline from May levels. Though the decrease appears relatively modest, it signals diminishing performance in Malaysia's most crucial downstream export category following the pandemic-era surge. The segment faces pressures from excess supply capacity, escalating competition from Vietnamese and Chinese producers, and reduced global purchasing activity.

Import Dynamics and Demand Patterns Reveal Structural Vulnerabilities

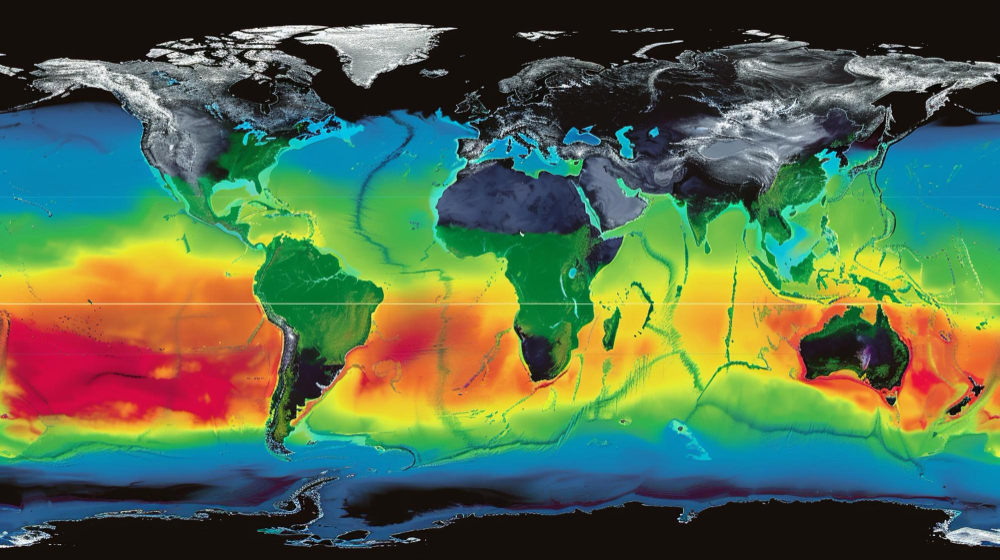

Import figures presented a nuanced picture. June imports reached 56,398 tons, marking a 2.7% increase year-over-year but falling 7.3% short of May's volume. Standard Rubber (17,968 tons) and Scrap (17,778 tons) constituted the dominant import categories. Thailand remained the principal supplier with 20,802 tons, followed by Ivory Coast at 14,590 tons, the Philippines at 5,831 tons, and Vietnam at 3,854 tons.

This moderation extends a broader pattern: imports consistently exceeded the 100,000-ton mark between November 2024 and February 2025 but have declined steadily since. The retreat reflects multiple converging factors—geopolitical instability, diminishing post-pandemic global demand, and the dampening impact of U.S. tariffs on Malaysian rubber product exports. While import dependency highlights Malaysia's need for foreign feedstock to satisfy specific grade requirements, the shifting trajectory indicates a fundamental realignment in the nation's trade patterns.

Domestic consumption figures painted an equally concerning picture. June demand fell 6.4% year-over-year to 19,312 tons, and dropped 4.6% below May levels. The glove manufacturing sector continued to dominate consumption with 12,101 tons, representing 62.7% of total domestic usage. Nevertheless, weakened downstream orders combined with tariff impacts and geopolitical disruptions affecting glove exports have constrained overall demand.

This dual phenomenon—imports declining from recent peaks while domestic consumption weakens—exposes the structural constraints confronting Malaysia. The country hesitates to increase import reliance, yet domestic production capacity remains unable to gain momentum. Simultaneously, downstream industries that historically anchored rubber demand face limitations from softer international orders amid tariff headwinds. This triple constraint—restricted imports, depressed consumption, and vulnerable production—deprives Malaysia's rubber sector of any dependable foundation for stability.

Inventory levels declined precipitously in June, falling 11.4% to 164,189 tons from May's 185,324 tons. Processors maintained the majority share at 85.2%, with consumer factories holding 14.7% and estates accounting for just 0.1%. The inventory reduction reflected both diminished import volumes and stagnant domestic production.

Pronounced Price Fluctuations Complicate Strategic Planning

Price volatility emerged as a defining characteristic of the period. SMR20 prices, as assessed by Helixtap, climbed from US$1,700 per metric ton at the end of May to US$1,725/mt in early June, before retreating to US$1,670/mt by June 20. A subsequent rebound drove prices to US$1,800/mt on July 25, only to decline again to US$1,720/mt by August 1. Mid-August witnessed prices recovering to US$1,770/mt. This turbulence reflects the delicate equilibrium between fluctuating global demand—particularly from China's automotive sector—and supply constraints. While price increases provide temporary respite for Malaysia, the persistent volatility undermines effective planning for both producers and purchasers.

The data illustrates an industry ensnared in structural paralysis. Government efforts to enhance output have failed to yield substantial improvements, while climatic conditions continue to disrupt tapping activities. The excessive dependence on smallholders uncertain about their future trajectory—many of whom have already transitioned to oil palm cultivation—represents Malaysia's most fundamental weakness, rendering production extremely susceptible to labor deficiencies. Foreign worker recruitment has yet to meaningfully address workforce shortages. Concurrently, exports are weakening and domestic consumption remains subdued.

Urgent Reform Required to Prevent Further Deterioration

The imperative is unmistakable: Malaysia's rubber sector cannot depend on cyclical price recoveries or incremental policy adjustments. Comprehensive structural transformation—revitalizing plantations, modernizing estate operations, training adequate numbers of tappers (particularly younger workers), incentivizing smallholders to maintain rubber cultivation, attracting youth to replace an aging workforce, implementing systematic replanting programs, and expanding value-added manufacturing capacity—is absolutely essential. Additionally, harmonizing production and trade practices with global sustainability frameworks such as the EU Deforestation Regulation could enhance long-term competitive positioning, an approach Vietnam has already begun pursuing.

Currently, Malaysia's natural rubber sector stands at a critical juncture. Without decisive and sustained intervention, it risks ceding additional ground to regional competitors and emerging producers like Ivory Coast, which have achieved more balanced production systems and advanced further up the value chain. The second half of 2025 will prove decisive in determining whether Malaysia can mobilize meaningful reform momentum or remain trapped in cycles of chronic weakness.

This analysis draws from research and insights provided by Helix Tap. For more market intelligence and analysis, visit helixtap.com