Southeast Asia's Rubber Belt Braces for Above-Normal Monsoon Rains

Executive Summary

The 2025 South Asian monsoon season is delivering exceptional news for rubber producers across Southeast Asia. Major rubber-producing nations including Vietnam, Thailand, Cambodia, and Indonesia are positioned to receive above-normal rainfall through the critical June-July period, creating optimal conditions for latex production and tree health.

Key Takeaways:

- Vietnam, Thailand, Cambodia, and Indonesia expect 20-30% above-normal rainfall

- Neutral ENSO conditions with La Niña-like patterns favor sustained precipitation

- Production outlook remains strong despite potential short-term weather disruptions

- Ivory Coast faces more uncertain conditions compared to Asian producers

The Meteorological Foundation

The current monsoon season represents a convergence of favorable atmospheric conditions rarely seen in recent years. Dr. S Abhilash, Director of the Advanced Centre for Atmospheric Radar Research at Cochin University of Science and Technology, explains that large portions of western Vietnam, Cambodia, southern Thailand, and eastern Indonesia will experience normal to above-normal rainfall beginning in early June, intensifying to widespread above-normal precipitation through late June.

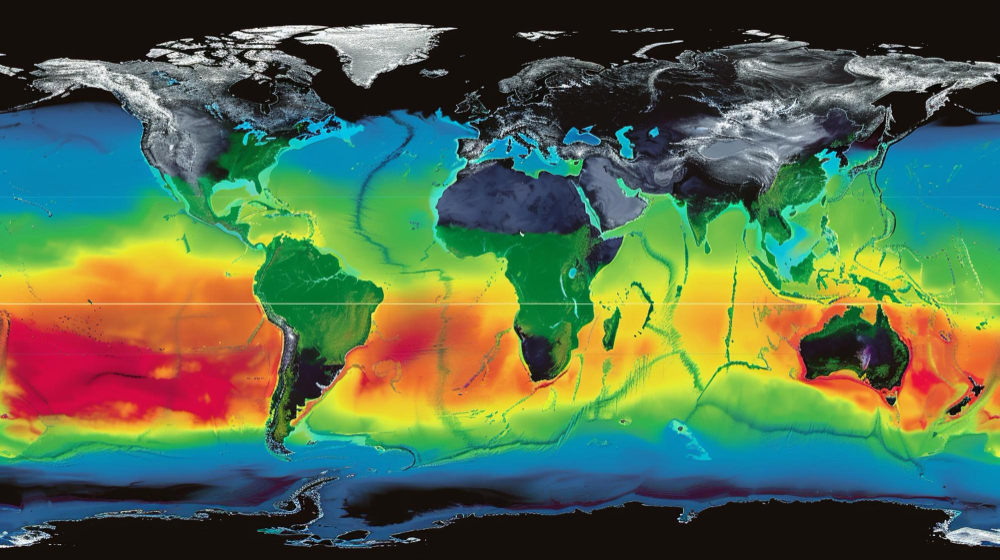

This weather pattern stems from the prevailing ENSO-neutral conditions over the Pacific, which meteorologists expect to persist throughout the season. What makes this year particularly interesting is the atmospheric circulation's shift toward La Niña-like characteristics, historically associated with enhanced rainfall across the maritime continent and mainland Southeast Asia.

The Indian subcontinent's robust southwest monsoon is already delivering substantial rainfall to the country's primary rubber-producing regions along the West Coast and Northeast. This monsoon strength is creating beneficial spillover effects for neighboring countries including southern Myanmar, Thailand, and Cambodia.

Several global factors are reinforcing this positive outlook. The combination of neutral ENSO conditions, neutral Indian Ocean Dipole, and reduced Northern Hemisphere snow cover—a variable that correlates with stronger summer rainfall—has created an atmospheric recipe for sustained monsoon activity.

Country-by-Country Production Outlook

Indonesia: Maritime Advantage Drives Recovery

Indonesia's vast plantation network across Sumatra and Kalimantan is particularly well-positioned to capitalize on the improved rainfall patterns. After experiencing inconsistent precipitation during the tail end of El Niño conditions, the archipelago's rubber sector is set for stabilization under the current neutral ENSO setup.

The southern regions of Sumatra and Java, which experienced minor rainfall deficits earlier this year, are forecast to recover significantly through June and July. This recovery will reduce hydrological stress on rubber trees and improve productivity during the peak harvesting months. The shift toward above-average rainfall supports both latex regeneration and optimal tapping cycles, though producers must remain vigilant about excessive rainfall that could disrupt operations.

Vietnam and Cambodia: Growth Window Opens

Vietnam's rubber sector stands to benefit substantially from an extended wet period featuring frequent moderate-to-heavy rainfall through June and July. This precipitation pattern will improve soil moisture profiles and particularly benefit younger plantations still in their establishment phase. However, mature plantations may experience temporary tapping interruptions during heavy rain periods.

Cambodia presents an equally promising picture, especially in the central and western provinces of Kampong Thom and Kampong Cham. The forecast for timely and consistent rainfall represents a welcome change after several years of irregular monsoon patterns. Regional stakeholders in both countries are preparing for high-activity seasons, with smooth plantation operations anticipated provided flooding remains manageable.

Thailand: Abundant Rains for Core Regions

Thailand's principal rubber-growing areas in the southern peninsula and northeast are projected to experience frequent rainfall events throughout the early monsoon window. This aligns with both national forecasts and regional models indicating favorable convective activity driven by a supportive monsoonal trough.

Critical provinces including Surat Thani, Trang, and Yala—backbone regions of Thailand's rubber economy—are expected to receive above-normal rainfall. However, the Thai Meteorological Department has issued advisories regarding possible intense rainfall surges, particularly if tropical disturbances develop in the South China Sea. Plantation operators are advised to monitor field access and drainage conditions closely, especially in flood-prone areas.

Storm Risks and Short-Term Challenges

While the overall outlook remains positive, forecasters are monitoring potential tropical storm activity in the western Pacific over the next 6-8 weeks. Although not all systems are expected to make landfall, their indirect effects—including heavy rainfall bands, gusty winds, and localized flooding—could temporarily affect latex tapping operations in coastal and upland areas of Thailand and Vietnam.

These weather disruptions, while typically short-term, have the potential to delay harvests or impact logistics in remote plantation areas. The eastern parts of Indonesia, including Sulawesi and the Maluku Islands, may experience above-normal rainfall levels in the first half of June, with improved moisture conditions extending to typically drier western regions.

Africa's Contrasting Picture

Ivory Coast, Africa's largest rubber producer, faces a markedly different scenario compared to its Asian counterparts. While entering its long rainy season, the region confronts mixed climate signals influenced by global warming and Atlantic sea surface temperature anomalies.

The World Meteorological Organisation's latest Africa climate update suggests irregular precipitation trends across the region. Adding complexity, NOAA forecasts indicate a potentially active Atlantic hurricane season, which could indirectly affect West African rainfall patterns. While hurricanes don't directly strike Ivory Coast, their formation can draw moisture away from the Gulf of Guinea region or destabilize atmospheric conditions, potentially resulting in sporadic rainfall interruptions or intensity fluctuations.

Despite these challenges, industry experts maintain cautious optimism for a reasonably productive season in the region, though output may lag behind the exceptional conditions expected across Southeast Asia.

Strategic Implications for the Rubber Market

The convergence of favorable monsoon conditions across Southeast Asia's primary rubber-producing regions creates a foundation for strong latex output through the critical mid-year period. Thailand, Vietnam, Indonesia, and Cambodia appear exceptionally well-positioned for a productive cycle, assuming effective management of localized flooding and storm risks.

However, industry stakeholders must prepare for a season of contrasts. While Asian producers benefit from optimal growing conditions, the uncertain outlook for Ivory Coast could create regional supply imbalances. This dynamic may influence global rubber pricing and trade flows as the season progresses.

Experts emphasize that the changing rainfall patterns underscore the increasing importance of advanced rain protection systems in rubber plantations. Enhanced rainguarding infrastructure will be crucial for maintaining consistent tapping operations despite the anticipated increase in precipitation intensity.

As the 2025 monsoon season unfolds, the rubber industry finds itself at a critical juncture—with the potential for exceptional production gains in Asia balanced against weather uncertainties in Africa. Success will depend on how effectively producers adapt their operations to capitalize on favorable conditions while mitigating weather-related disruptions.

Source: Analysis based on an a publication by Helixtap Technologies.